Date:2025-11-21 14:35 UTC

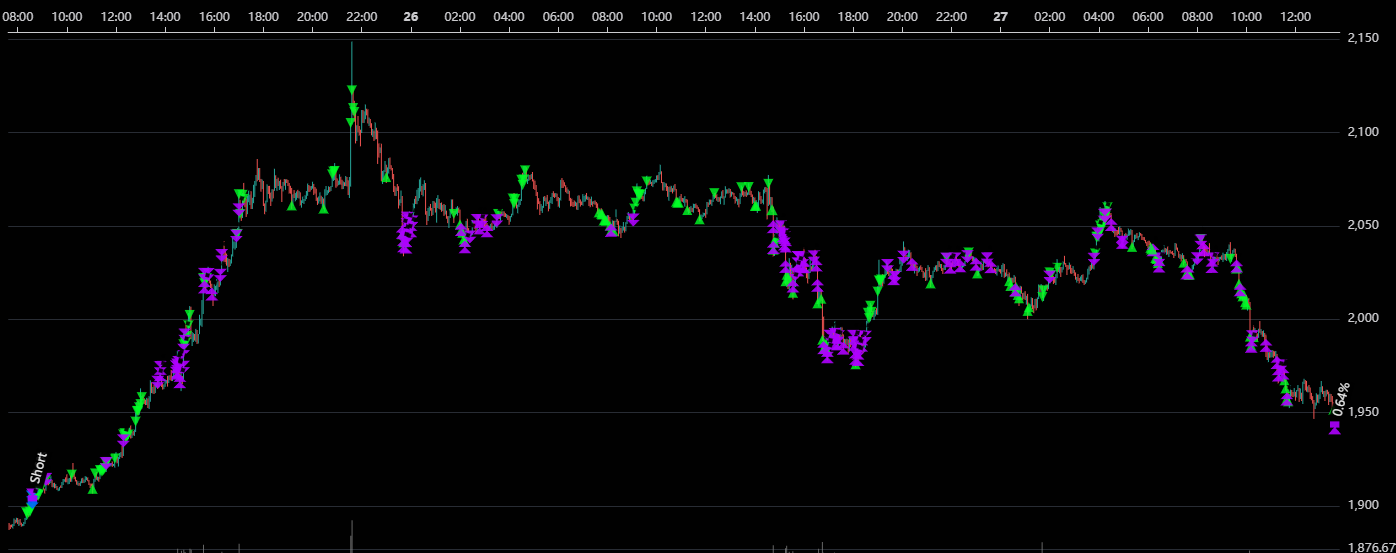

| Token Icon | Coin | Current Price | 24h High | 24h Low | Volatility |

|---|---|---|---|---|---|

|

Bitcoin | $84,603.36 | $89,850.70 | $80,820.20 | -10.05% 🔴 |

|

Ethereum | $2,770.35 | $2,961.10 | $2,627.45 | -11.26% 🔴 |

Note: Price data is a snapshot; please invest with caution.

🖥️ Winbay Quant Trade Agent Live Performance:

Net Profit: +1.12%, Win Rate: 100%

Industry News Flash

KEY POINTS

- Record Exits: US retail investors have liquidated a record $4 billion in crypto ETFs this month.

- Miner Stress: Bitcoin has fallen below JPMorgan’s estimated "production cost" of $94,000, a key technical floor.

- MSTR Alert: MicroStrategy faces a potential exclusion from MSCI indices, which could trigger an $8.8 billion passive sell-off.

The cryptocurrency market is facing a convergence of bearish signals this November as retail sentiment sours and key fundamental support levels give way.

New data indicates that the current market correction is being driven by a historic retreat of non-native crypto investors, compounded by technical breakdowns that suggest increasing stress on the Bitcoin mining network.

Retail Exodus Hits New Peaks

November has proven to be a brutal month for crypto sentiment among Main Street investors.

Since the start of the month, US retail investors have liquidated approximately $4 billion in Bitcoin and Ethereum spot ETFs. This represents a record high for monthly outflows, surpassing the previous panic-selling peak observed in February earlier this year.

Analysts note that this sell-off differs significantly from the correction seen in October. While the October dip was driven by crypto-native investors deleveraging, the current wave of selling is being led primarily by traditional retail investors, signaling a broader loss of confidence among the "tourist" class of market participants.

Bitcoin Drops Below Production Cost

Compounding the bearish outlook, Bitcoin’s price action has breached a critical fundamental threshold.

For the first time since July 2020, Bitcoin has fallen below JPMorgan’s estimated average "production cost" of approximately $94,000.

This metric is closely watched by institutional analysts as it typically represents a hard floor for Bitcoin prices. A drop below production cost implies that miners are now operating at a loss or with razor-thin margins. Historically, extended periods below this level have served as indicators of miner capitulation and extreme market weakness.

Speculative Capital Retreats

According to market analysis from JPMorgan, the current downturn reflects a broader drying up of speculative liquidity.

While institutional players remain watchful, the "gambling cohort" of retail investors—those typically active in high-leverage trades and speculative assets—appears to be retreating from the market entirely. This withdrawal of high-risk capital has removed a key layer of buying pressure that previously supported valuations.

Looming Risk: The MicroStrategy Exclusion

Looking ahead, investors face a significant catalyst in early 2026 involving MicroStrategy (MSTR), the largest corporate holder of Bitcoin.

The company is currently at risk of being removed from major indices managed by MSCI Inc. If MicroStrategy is deleted from these benchmarks, it would trigger an estimated $8.8 billion in forced selling by passive index funds.

With the decision scheduled for January 15, this potential liquidity shock poses a serious threat to MSTR’s valuation and could introduce further volatility to the broader digital asset ecosystem.

Disclaimer: This content is for informational purposes only and should not be considered investment advice.