Date:2025-11-22 22:35 UTC

| Token Icon | Coin | Current Price | 24h High | 24h Low | Volatility |

|---|---|---|---|---|---|

|

Bitcoin | $82,766.27 | $84,577.10 | $83,503.50 | -1.26% 🔴 |

|

Ethereum | $2,766.27 | $2,798.10 | $2,735.61 | -2.25% 🔴 |

Note: Price data is a snapshot; please invest with caution.

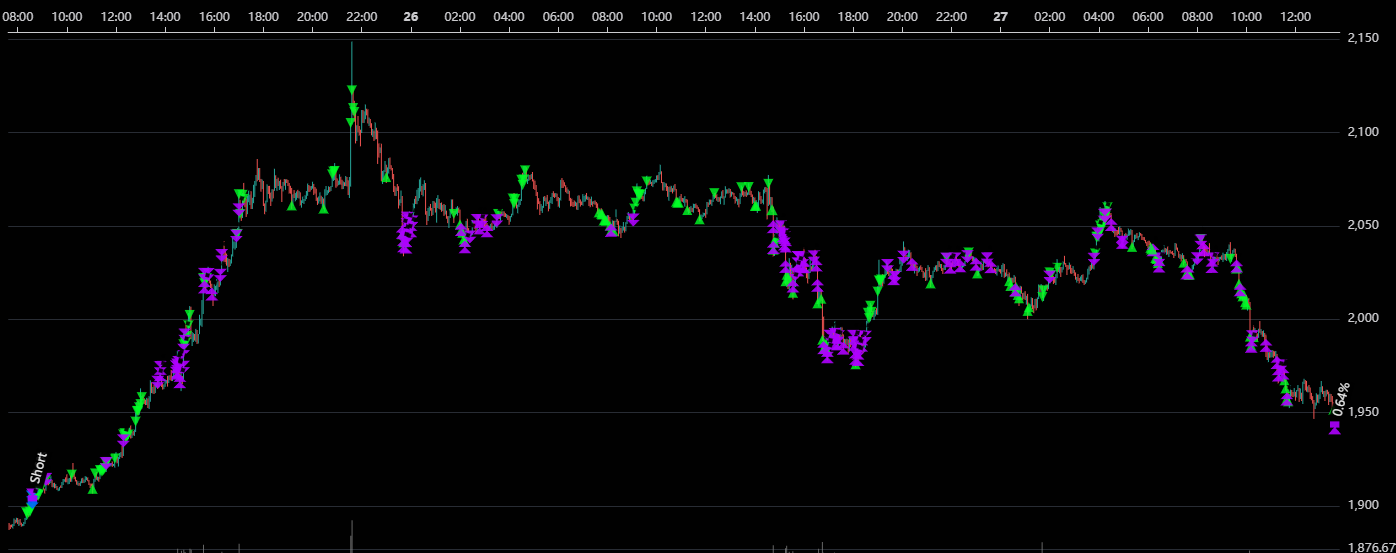

🖥️ Winbay Quant Trade Agent Live Performance:

Net Profit: +1.02%, Win Rate: 100%

Here is a summary of the key news from the day, categorized by market performance, security incidents, regulations, and project updates:

1. Market Performance: Bitcoin Crash & "Extreme Fear"

- Bitcoin (BTC) Plummets: Bitcoin has seen a sharp decline, trading in the $80,000 - $84,000 range. This represents a drop of over 30% from its all-time high of approximately $126,000 set in October.

- Ethereum (ETH) & Altcoins: Ethereum has touched four-month lows, while major altcoins like Solana (SOL) and XRP have suffered double-digit percentage losses.

- Analysis of the Crash:

- Lagging Impact of the GENIUS Act: Analysts suggest the long-term effects of the "GENIUS Act" (Stablecoin regulation signed in July) are now materializing. While providing a compliance framework for stablecoins, the act strictly limits Bitcoin's role as a medium of exchange, shaking investor confidence in its utility.

- Macroeconomic Pressure: A sell-off in US tech stocks, combined with uncertainty regarding Federal Reserve interest rate policies, has led to a liquidity crunch affecting high-risk assets.

- Leverage Flush: Massive liquidations of leveraged long positions have accelerated the downward price spiral.

2. Critical Security Alert: DeFi Front-End Attacks

- Aerodrome & Velodrome Compromised: Aerodrome (the largest DEX on Base) and Velodrome (on Optimism) suffered front-end (DNS hijacking) attacks early on the 22nd.

- Attack Details: Hackers hijacked official domains (e.g., .finance and .box), tricking users into signing malicious transactions. Reports indicate users have lost over $1 million in a short period.

Urgent Advice: Do not visit or connect to official centralized domains. Users are advised to use decentralized mirrors (such as IPFS links) or stop interacting completely until official safety confirmations are issued.

3. Industry & Project Updates

Coinbase Derivatives Expansion: Coinbase announced the expansion of its derivative products, adding 24/7 futures trading for more altcoins (such as AVAX, DOGE, SHIB), indicating a strategic pivot toward hedging markets during spot volatility.

Summary & Next Steps: The market is currently hypersensitive. If you hold assets related to Aerodrome or Velodrome, please revoke permissions immediately and avoid their official websites. For Bitcoin investors, the $80,000 mark is currently being tested as a critical psychological support level while the market digests the regulatory and macro headwinds.