📉 Market and Price Dynamics (Core News)

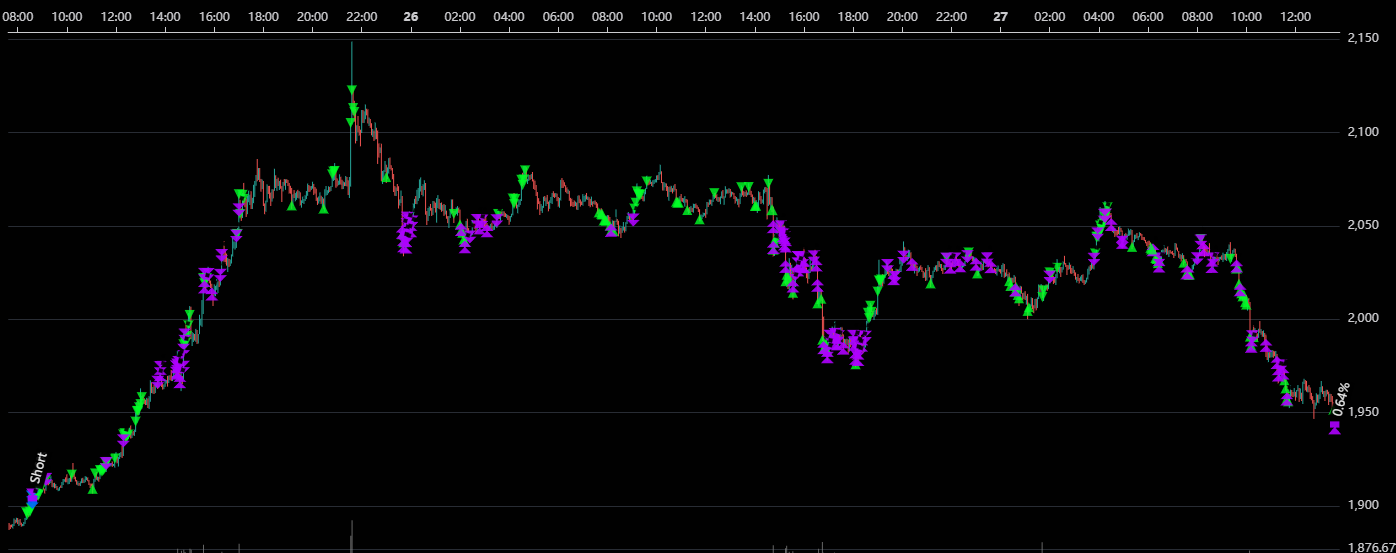

- Significant Market Sell-off: During the late night of December 1st and into December 2nd UTC, the cryptocurrency market experienced a sharp decline, with sentiment shifting to a "Risk-off Sentiment."

- Bitcoin (BTC): BTC dropped nearly 6% over a 24-hour period, breaking below the crucial $86,000 level and briefly hitting around $85,000 intraday. This followed a period of consolidation near $91,000.

- Ethereum (ETH): ETH fell approximately 5.85% to trade near $2,814.

- Altcoins: Most major altcoins, including XRP, BNB, Solana, Cardano, Tron, and Dogecoin, saw losses exceeding 10%.

- Liquidation Wave: The sudden drop in price triggered massive Long Liquidations. Over $300 million in leveraged long positions were liquidated within 24 hours, with the total liquidation amount surpassing $500 million, intensifying the panic selling in the market.

- Macroeconomic Pressure: The market decline was partly attributed to global macroeconomic signals:

- Bank of Japan (BOJ) Hike Expectation: Japanese government bond yields hit a 17-year high, and BOJ Governor Kazuo Ueda hinted at a possible rate hike. This strengthened the USD and JPY and potentially triggered the unwinding of "Yen Carry Trades," putting pressure on risk assets.

- U.S. Economic Data: The market was also awaiting key U.S. economic data later in the week, which would influence expectations for the Federal Reserve's 2026 interest rate path.

📰 Industry and Corporate News

- European Bitcoin Savings App Funding: The French Bitcoin savings application, Bitstack, announced the completion of a $15 million Series A funding round. The aim is to mainstream Bitcoin savings in Europe to combat inflation in the Eurozone.

- Stablecoin Rating Concerns: S&P Global Ratings had previously downgraded its stability assessment for the world's largest stablecoin, USDT, to its lowest rating. The agency warned that a sharp drop in Bitcoin's price could lead to insufficient collateralization for USDT, which added uncertainty to the market.

- China Reaffirms Crypto Ban: The People's Bank of China (PBoC) reiterated its ban on digital currencies and warned it would intensify its crackdown on stablecoins.

Summary: The crypto market on December 2nd was characterized by panic selling and massive liquidations. Bitcoin and other crypto assets saw a sharp pullback due to macro pressures and the failure of technical support levels. Analysts currently point to $80,000 as the next critical support level for Bitcoin.