[WASHINGTON D.C.] According to the latest market intelligence, the Trump administration is preparing to formally confirm Kevin Warsh as the nominee for the next Chair of the Federal Reserve. Data from the prediction market Polymarket shows Warsh’s nomination probability has surged to 94%, far outpacing other candidates. The official announcement is expected to be made around the afternoon of January 31 (Saturday) UTC.

Core Policy Stance: A Rare "Double-Edged" Approach

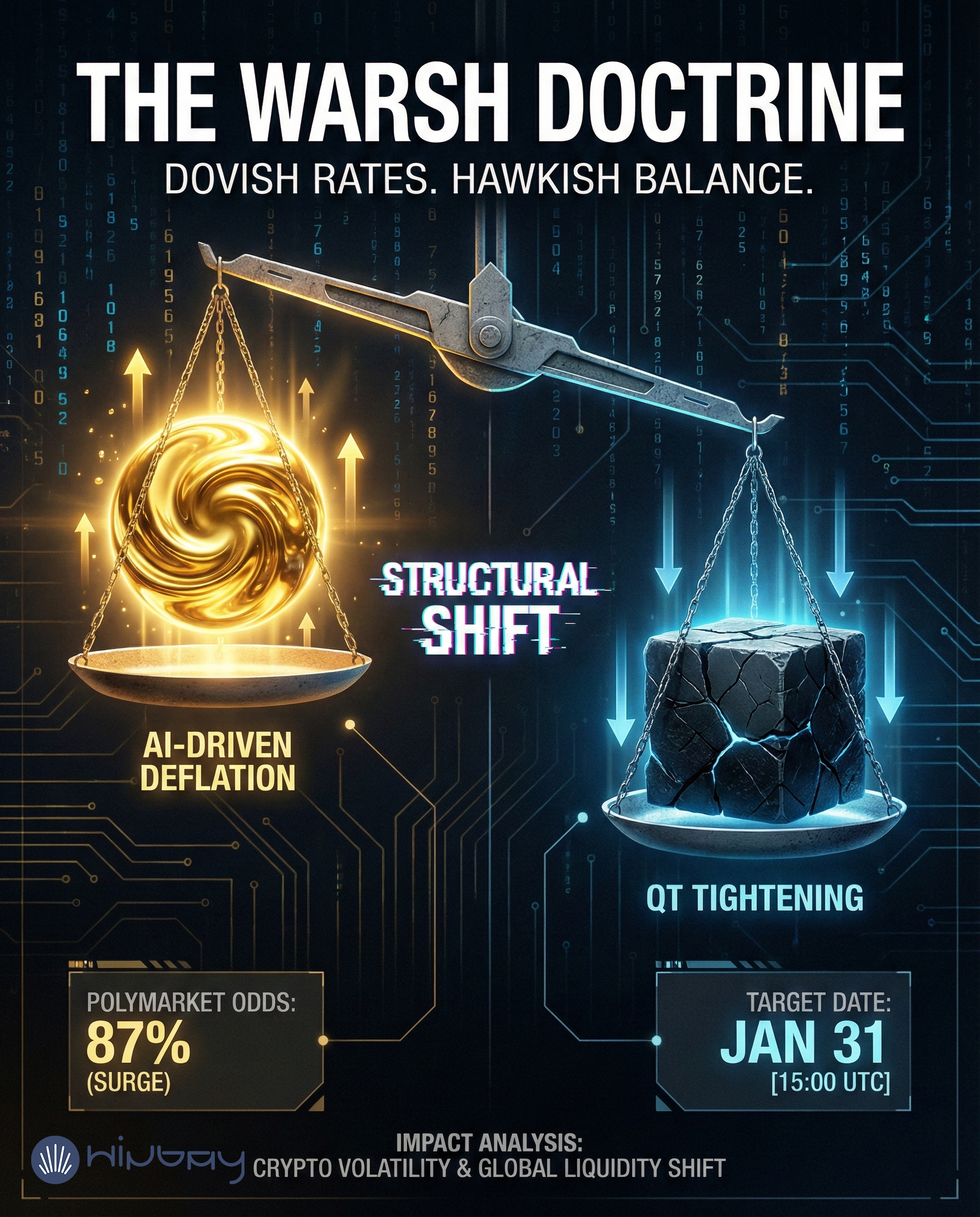

Kevin Warsh’s policy position has been described by analysts as a unique combination of being "Dovish on Interest Rates" but "Hawkish on the Balance Sheet." If implemented, this mix could have profound and complex implications for global financial markets and the cryptocurrency sector.

1. Dovish Interest Rate Policy (Bullish for Markets): AI-Driven Cuts Warsh’s views align closely with the Trump administration's demand for interest rate cuts of "2-3 percentage points."

- The Logic: Warsh argues that the massive productivity gains driven by Artificial Intelligence (AI) have a natural "deflationary effect."

- Policy Direction: Based on this logic, he supports significantly lowering the federal funds rate. This is viewed as a major positive for risk assets and tech growth stocks seeking lower financing costs.

2. Hawkish Balance Sheet (Potential Bearish Headwind): Ending QE In contrast to his stance on rates, Warsh is firmly opposed to Quantitative Easing (QE).

- Liquidity Tightening: He advocates for significantly shrinking the Federal Reserve's massive balance sheet. This implies that the primary source of liquidity that has supported markets since the 2008 financial crisis could face a reduction.

- Market Risk: Analysts at Deutsche Bank note that Warsh’s position of "lower policy rates combined with a smaller balance sheet" is highly unique. This structural shift could alter the long-term liquidity environment for risk assets—including cryptocurrencies—and may require regulatory reform to be implemented effectively.

Nomination Timeline & Confirmation Process (UTC+0)

Based on White House sources and historical precedents, the estimated schedule is as follows:

- Official Announcement: Expected around 15:00 UTC on January 31, 2026 (Corresponding to Saturday morning in Washington D.C.).

- Senate Hearings: Following the announcement, the nomination will move to the Senate Banking Committee for hearings, a process that typically takes several weeks.

- Final Confirmation Vote: While historical experience (such as Jerome Powell's 2018 confirmation) suggests a 2-3 week period from nomination to confirmation, this timeline could be extended due to political factors, including potential delays from Senator Tillis.

- Expected Start Date: Final confirmation is projected for late February to March.

Candidate Landscape Summary

In the final race for the nomination, Warsh has pulled ahead due to his professional policy stance and political alignment:

- Kevin Warsh (Probability: 94%):

- Stance: Moderately crypto-friendly.

- Impact: His aggressive "balance sheet reduction" stance raises concerns about market liquidity, despite favorable interest rate views.

- Kevin Hassett: Probability has dropped significantly. Known as "extremely dovish" and directly holds Coinbase shares (extremely crypto-positive), but is no longer the frontrunner.

- Rick Rieder: Probability 6-8%. A BlackRock executive who advocates for Bitcoin as a gold alternative, though his specific monetary policy stance remains less defined.

- Christopher Waller: Low probability. Technically neutral; advocates for the Fed to embrace DeFi and digital assets.